Asset

In finance, assets are classified into different categories based on their nature and how they are used. They can be tangible, financial instruments or intellectual property. Assets are usually divided into two main categories:

Tangible assets

They are tangible things that can be touched and seen. They include:

- Real estate: houses, commercial properties or land.

- Vehicles: cars, trucks and other means of transportation.

- Machinery: tools and equipment used in business operations.

- Cash and bank deposits: Money you have, including savings or checking accounts.

Intangible assets

Unlike tangible assets, intangible assets do not have a physical form, but they still have significant value. These include:

- Patents and copyrights: intellectual property, such as inventions or works of art.

- Brand Recognition: A strong, established brand can be a valuable asset to businesses.

- Goodwill: the value of a company’s name and customer loyalty.

Types of Assets

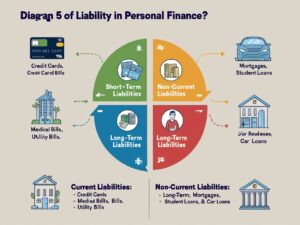

Assets can also be classified based on their liquidity (how easily they can be converted into cash) or their role in your financial life:

- Current assets: These are short-term assets that are expected to be converted into cash within one year, such as inventory or accounts receivable.

- Fixed assets: These are long-term investments, such as property, machinery, and equipment that are used over time.

- Investments: Stocks, bonds, mutual funds, and other financial instruments that you hold for income or capital appreciation.

- Personal assets: Things like your home, car, or personal savings.

Why are assets important?

Assets play a vital role in personal finances and business growth. Here’s why:

- Wealth Creation: Owning assets helps you accumulate wealth over time. Whether it’s through real estate appreciation or stock investments, assets can increase in value, contributing to your net worth.

- Income Generation: Some assets, such as rental properties or dividend-paying stocks, can generate regular income.

- Financial Security: Having a diverse portfolio of assets provides a safety net. It reduces financial risk by providing different sources of value and income.

How to Build Your Asset Portfolio

Creating an asset portfolio requires strategic planning and patience. Here are some steps to get started:

- Assess your current assets: Take inventory of what you already own and understand its value and growth potential.

- Diversify your assets: Invest in a mix of tangible and intangible assets. This can include real estate, stocks, bonds, and businesses to reduce risk.

- Focus on long-term investing: Building assets is a long-term game. Be patient and make informed decisions that align with your financial goals.

- Monitor and adjust: Regularly review your assets and adjust your plan as needed to stay on track to achieve your financial goals.

Conclusion

Assets are the foundation of financial success, whether you’re just starting to build wealth or looking to expand your current portfolio. By understanding the different types of assets and making smart investment decisions, you can protect your financial future and grow your wealth over time.