Income

Income refers to the money or income you receive in exchange for your work, investments, or other resources. It is the flow of money that supports your daily life, allowing you to pay for expenses such as food, housing, entertainment, and so on.

Income can come from a variety of sources. They are divided into two categories:

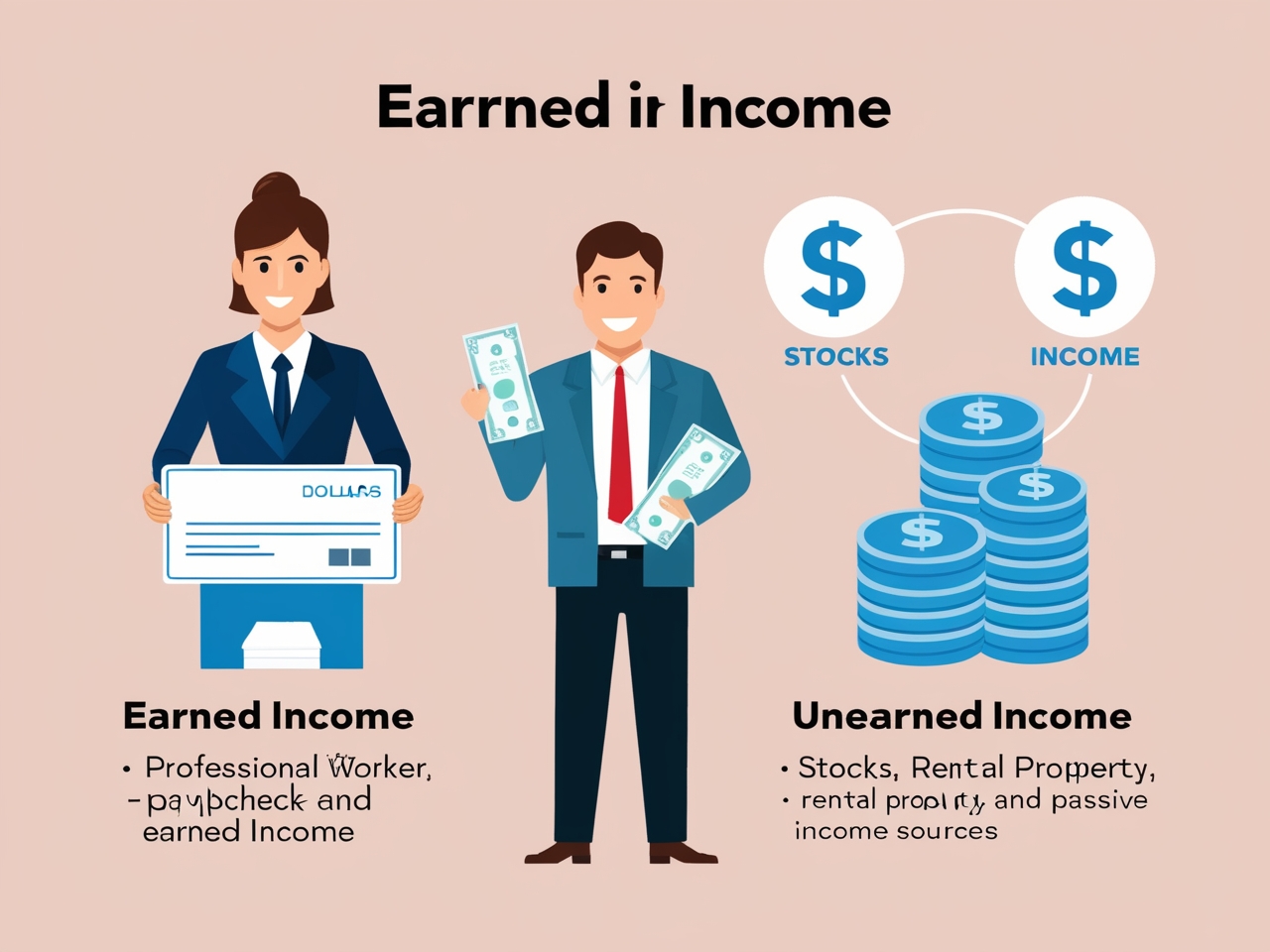

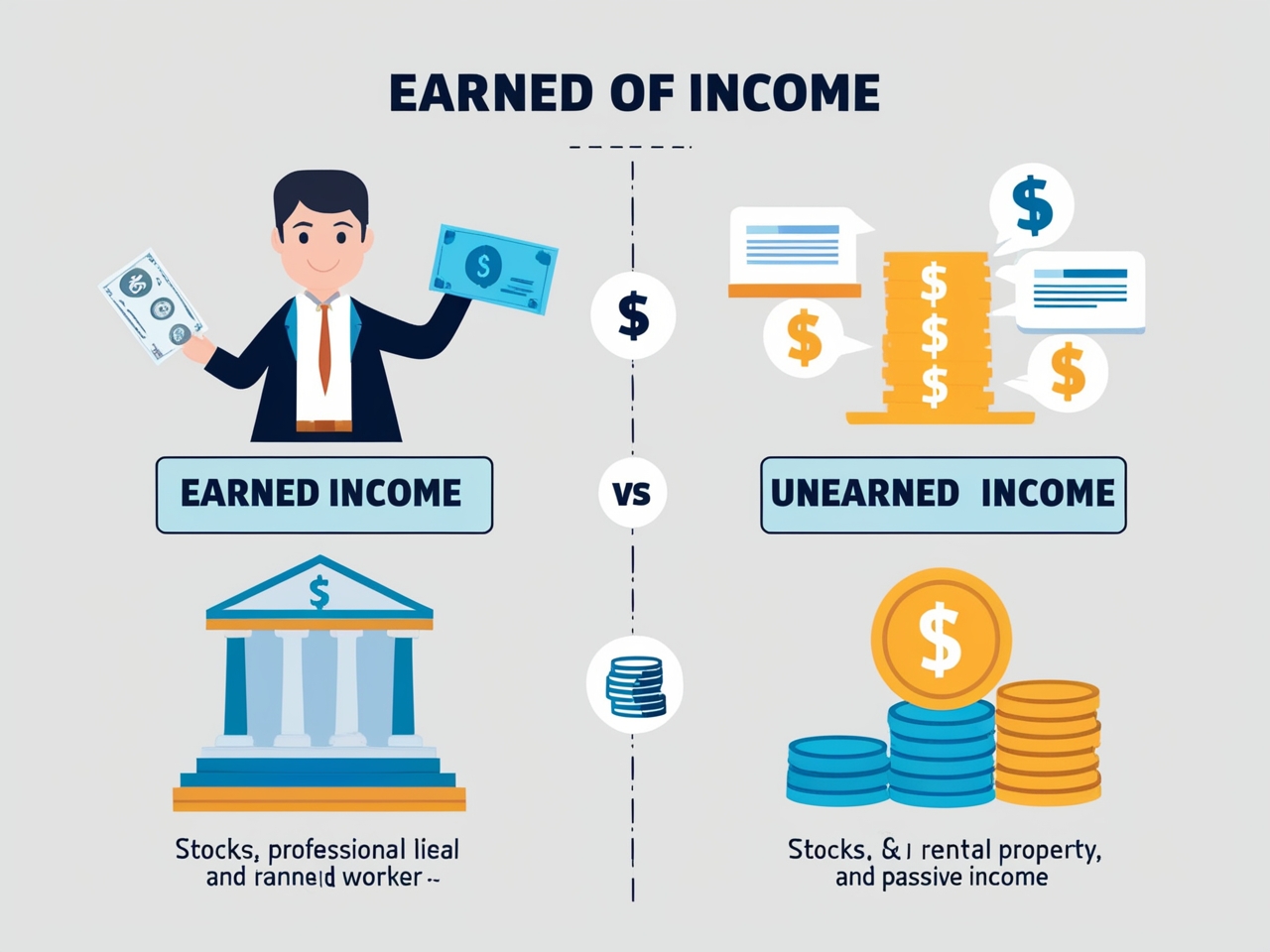

Earned income

This is money you earn from work. Whether you work full-time, part-time, or are self-employed, your salary, wages, or compensation for these activities is counted as earned income. For example, if you work for a company, your monthly salary is your salary.

Unearned income

This income is generated from sources other than employment. Some examples include interest from savings accounts, dividends from stocks, rental income from property, or income from investments such as real estate or mutual funds. Indirect income, which requires ongoing effort once established, also falls into this category.

Why is income important?

Income plays a significant role in your financial well-being. It directly affects your standard of living, how much you can save or invest, and your ability to achieve your future financial goals. The more income you have, the more choices and opportunities you will have to improve your life.

For example, a higher income can allow you to:

- Pay off debt faster

- Save for emergencies or retirement

- Invest long-term to build wealth

How to manage your income

Managing your income is key to achieving financial success. The first step is to create a budget that takes into account both fixed expenses (like rent or mortgage) and variable expenses (like entertainment or food). This ensures that you don’t spend more than you earn, allowing you to save and invest for the future.

Income management tips:

- Track your income and expenses to see where your money is going.

- Set aside a portion for savings and investments to build wealth over time.

- Diversify your income sources by looking at side jobs, investments, or passive income opportunities.

Conclusion

In short, income is the money that supports your lifestyle. Whether it comes from your job or from unpaid investments, understanding your income sources and managing them wisely is essential to financial stability. By budgeting, saving, and investing, you can make your income work for you and ensure a better financial future.